Tower Resources plc, an AIM-listed oil and gas company focused on Africa, has announced plans to raise N$12.9 million (£550,000) through a share subscription to fund ongoing work commitments, including data acquisition on its Namibian licence.

The company said the subscription involves the issue of 1.96 billion ordinary shares at 0.028 pence per share, representing a 15% discount to its closing bid price on 16 October 2025.

The proceeds will be used to support working-capital needs and maintain project momentum as Tower prepares for drilling activities in Cameroon during the first quarter of 2026.

“This is an exciting and very active period for us. Our understanding remains that documentation of our various approvals in Cameroon and Namibia is proceeding as previously disclosed. However, we need to maintain readiness for drilling in Cameroon in Q1 2026, and we also need to keep our work programme on track in Namibia, where our entry to the First Renewal Period has already been approved. Therefore, we have decided that a small capital raise at this time will aid in supporting these goals and our overall schedule, pending the receipt of farm-out funds,” the company said.

Tower also announced that Axis Capital Markets Limited, which arranged the subscription, will receive 49.1 million broker warrants with a three-year term, exercisable at 0.056 pence per share — equivalent to a 100% premium to the subscription price.

Following the transaction, Tower Resources’ enlarged issued share capital will stand at 31.28 billion ordinary shares, with the new shares expected to begin trading on 23 and 31 October 2025 in two equal tranches.

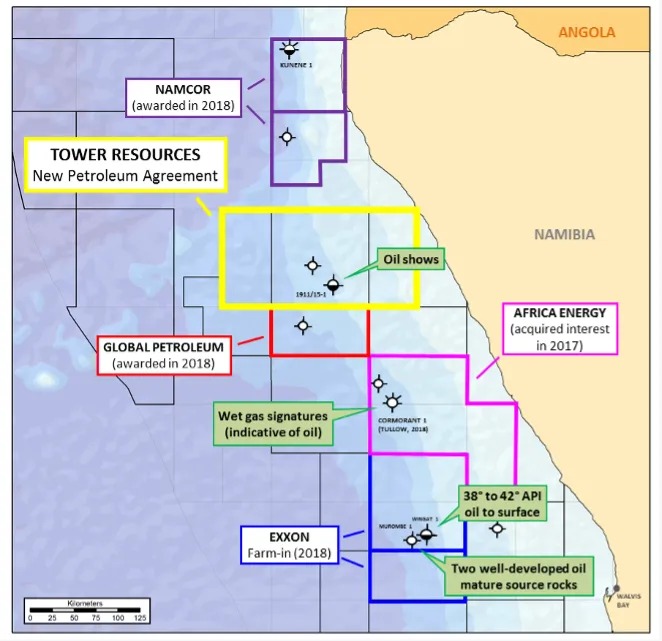

Tower Resources continues to strengthen its presence in Africa’s energy sector through exploration and development projects in Namibia, Cameroon and South Africa, focusing on stable jurisdictions and strategic partnerships aimed at unlocking new oil and gas opportunities across the continent.