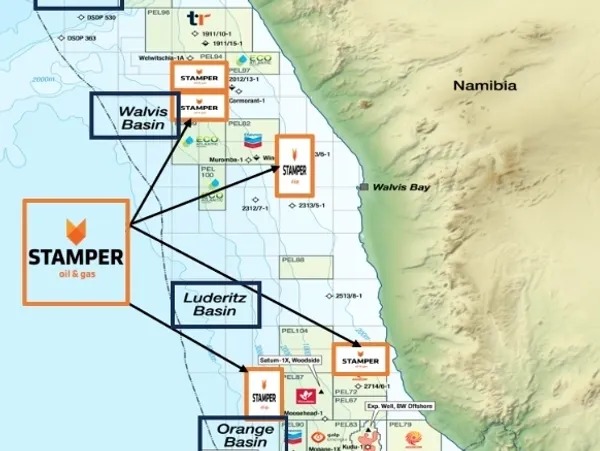

Stamper Oil & Gas Corp. says it is positioning itself to benefit strategically from the expansion of global energy companies into Namibia’s Lüderitz Basin.

Following the recent entry of TotalEnergies and Petrobras into the basin, Stamper said its diversified portfolio is now located adjacent to some of the most closely watched exploration blocks along the Atlantic margin.

According to Stamper Chief Executive Officer Grayson Andersen, the company’s core strategy involves holding high-quality assets in close proximity to blocks operated by major international energy companies. He said this “neighbourhood effect” was highlighted following the move by TotalEnergies and Petrobras into PEL 104 in the Lüderitz Basin, which he described as a significant technical and commercial catalyst for the company.

“With TotalEnergies and Petrobras entering the Lüderitz Basin offshore Namibia, it confirms our strategy of acquiring high-quality oil and gas exploration assets offshore Namibia, in proximity to PELs operated by supermajors. Our PEL 107 (32.9% working interest) asset in the Orange Basin sits adjacent to PEL 90 operated by Chevron, and now adjacent to PEL 104 operated by TotalEnergies,” Andersen said.

He added that, unlike many junior explorers focused on a single play, Stamper has secured a presence across three of Namibia’s four offshore basins. This diversification, he said, increases the probability of technical success as exploration activity by neighbouring operators expands.

Andersen said maintaining exposure in the Orange, Lüderitz and Walvis basins allows the company to mitigate risks associated with individual geological structures while retaining exposure to potential upside across multiple discovery zones.

“Stamper’s strategy from the outset has been to acquire high-quality blocks offshore Namibia in multiple basins which have the potential to be as good as or better than the results obtained to date in the Orange Basin. With PELs in each of the Orange Basin (PEL 107), the Lüderitz Basin (PEL 102) and the Walvis Basin (PEL 106 and PEL 98), we are well positioned to create value not only from activities on our PELs, which include the acquisition of seismic data, farm-outs and eventually the drilling of exploration wells, but also from the activities of others offshore Namibia,” he said.

The company said its strategy focuses on a multi-stage value creation plan beginning with the acquisition and analysis of seismic data, using regional exploration results to refine its own 3D geological models. This approach is intended to support future farm-out agreements with larger operators to fund exploration drilling, particularly on its high-interest position in PEL 107.