Noronex Limited has agreed to sell its non-core Witvlei Copper Project in Namibia for N$50.4 million (A$4.5 million) in a staged cash transaction to privately owned Joint Era Mining Co. (JEM).

Under the agreement, Noronex will receive 80% of the proceeds, amounting to N$40.4 million (A$3.6 million), with the remaining 20% allocated to its joint venture partner, Larchmont Holdings.

Noronex Managing Director and CEO, Victor Rajasooriar, said proceeds will support the company’s exploration strategy.

“The total cash proceeds from the sale, comprising $4.5 million in staged payments, will be used to explore at the Etango North Uranium Project, where our maiden drilling programme is expected to commence in early 2026,” he said.

The deal includes an initial non-refundable option fee of N$2.24 million (A$200,000), payable within seven days of signing. A Tranche 1 payment of N$14 million (A$1.25 million) will follow after a three-month exclusivity and due diligence period.

Once a mining licence is granted, JEM will pay a further N$14 million (A$1.25 million) milestone payment.

The final component is a deferred consideration of N$22.4 million (A$2 million), payable via a 2% Net Smelter Return royalty after commercial production begins and continuing until fully settled.

As part of the transaction, JEM will be issued 20 million Noronex share options at a strike price of 2.4 cents, which Noronex says reflects the buyer’s confidence in the company’s remaining projects in Namibia and Botswana.

Rajasooriar said the sale strengthens the company’s position.

“It will also strengthen our balance sheet, putting us in a much stronger position to pursue attractive new business development opportunities across the Kalahari Copper Belt, whilst rationalising the broader portfolio within the company,” he said.

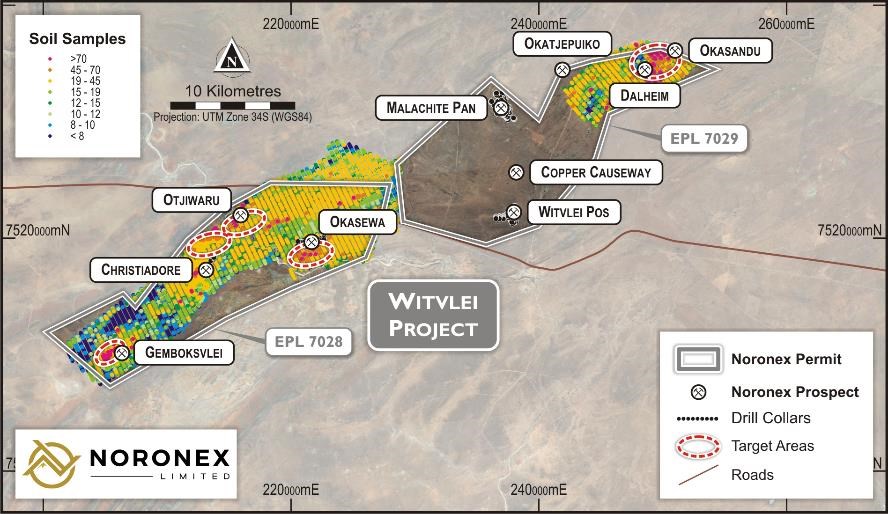

The Witvlei Project, located on EPLs 7028 and 7029, contains a JORC-compliant resource of 8.8 million tonnes at 1.28% copper, representing approximately 112,500 tonnes of contained copper metal.

The project covers just 3.5% of Noronex’s 858,000-hectare Namibian licence portfolio, situated at the western edge of the company’s broader copper belt holdings.