Noronex Limited has received a non-refundable deposit of approximately N$2.4 million (A$200,000), marking a key step in the proposed N$50 million (A$4.5 million) sale of its non-core Witvlei Copper Project in Namibia.

The payment, made by Joint Era Mining Co., Limited (JEM), triggers a three-month exclusivity period during which the South African–based buyer will conduct due diligence on the asset.

The option fee was paid on an 80:20 basis to Noronex and its joint-venture partner, Larchmont Holdings, as outlined in the Binding Heads of Agreement signed on 24 November 2025.

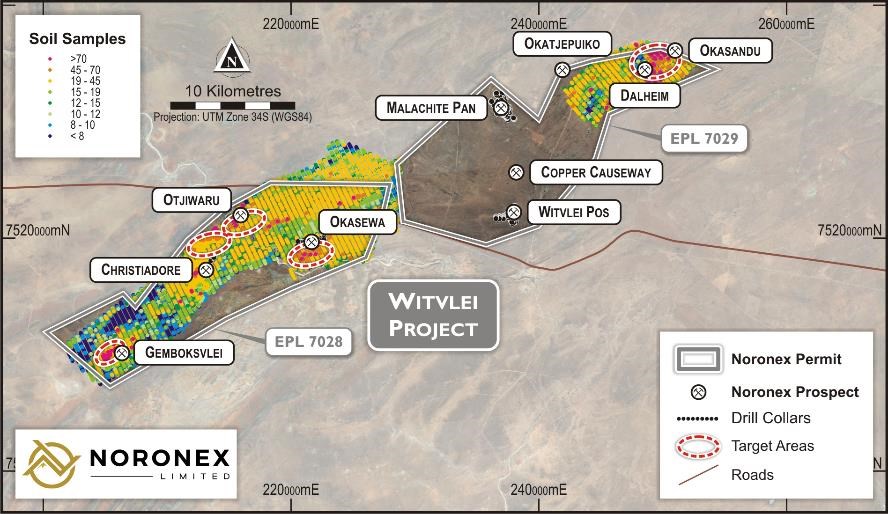

Once completed, the transaction will see JEM acquire the Witvlei Project, located within EPL 7028 and 7029 and covering 29,000 hectares at the western end of Noronex’s extensive Kalahari Copper Belt exploration package.

“The total consideration value of the transaction is A$4.5 million, payable in stages. The full details and terms of the transaction were outlined in the ASX announcement of 24 November 2025,” the company said.

Noronex noted that divesting the non-core project will allow the ASX-listed explorer to concentrate its resources on its flagship Humpback, Damara and Powerline targets.

These priority projects sit within the company’s strategic alliance and earn-in agreements with South32, under which the major miner may acquire up to 60% of selected Namibian and Botswana assets by funding exploration.

The Witvlei and Dordabis licences together host a JORC 2012 resource of 10 million tonnes at 1.3% copper.

Noronex added that it will continue progressing exploration across its broader 858,000-hectare portfolio in Namibia and Botswana and will provide further updates on the Witvlei transaction as developments unfold.