Lamda Energy (Pty) Ltd has signed an agreement to acquire an 85% working interest and operatorship in Petroleum Exploration Licence 98 (PEL 98), also known as Block 2213 or the Sharon Block, from Eco Atlantic Oil & Gas.

Lamda Energy (Pty) Ltd has signed an agreement to acquire an 85% working interest and operatorship in Petroleum Exploration Licence 98 (PEL 98), also known as Block 2213 or the Sharon Block, from Eco Atlantic Oil & Gas.

Fernando Sylvester, Founder and Chief Executive of Lamda Energy, said the acquisition marked a major milestone for the company.

“Namibia is rapidly emerging as one of the world’s most exciting frontiers for hydrocarbon exploration. Recent discoveries in the Orange Basin have improved our understanding of the Walvis Basin’s potential, and we are committed to progressing PEL 98 to create value for our stakeholders and for the people of Namibia. This acquisition is a major milestone for Lamda Energy and underlines our dedication to playing a leading role in Namibia’s energy future. As a wholly Namibian-owned company, we bring local expertise, solid regulatory knowledge and a deep commitment to developing our nation’s resources responsibly and sustainably,” he said.

“Having worked closely with Eco Atlantic Oil & Gas and with nearly 17 years of offshore experience across Southern Africa, my team and I have a strong, practical and in-depth understanding of the region’s geological and geophysical setting. We recognise the significant opportunity PEL 98 presents and are pleased to take the baton from Eco Atlantic, whose work laid significant groundwork for advancing operations on the licence.”

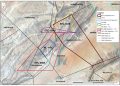

PEL 98 covers about 5,700 square kilometres in the Walvis Basin, close to recent offshore discoveries and containing multiple high-potential exploration targets.

NAMCOR Namibia retains a 10% participating interest, while Titan holds 5%. The transaction remains subject to approval by the Ministry of Industries, Mines and Energy (MIME).

Lamda Energy said the deal increases Namibian ownership in the oil and gas sector, enhances local content, and provides direct benefits to the economy.

Eco Atlantic will continue to support the transition with technical expertise and will retain a seat on the board.

The agreement includes an upfront payment to cover administrative costs and provisions for Eco Atlantic to receive up to US$2 million (about N$37 million) if Lamda later farms out part of its stake to a third party.

, Founder and Chief Executive of Lamda Energy, said the acquisition marked a major milestone for the company.

“Namibia is rapidly emerging as one of the world’s most exciting frontiers for hydrocarbon exploration. Recent discoveries in the Orange Basin have improved our understanding of the Walvis Basin’s potential, and we are committed to progressing PEL 98 to create value for our stakeholders and for the people of Namibia. This acquisition is a major milestone for Lamda Energy and underlines our dedication to playing a leading role in Namibia’s energy future. As a wholly Namibian-owned company, we bring local expertise, solid regulatory knowledge and a deep commitment to developing our nation’s resources responsibly and sustainably,” he said.

“Having worked closely with Eco Atlantic Oil & Gas and with nearly 17 years of offshore experience across Southern Africa, my team and I have a strong, practical and in-depth understanding of the region’s geological and geophysical setting. We recognise the significant opportunity PEL 98 presents and are pleased to take the baton from Eco Atlantic, whose work laid significant groundwork for advancing operations on the licence.”

PEL 98 covers about 5,700 square kilometres in the Walvis Basin, close to recent offshore discoveries and containing multiple high-potential exploration targets.

NAMCOR Namibia retains a 10% participating interest, while Titan holds 5%. The transaction remains subject to approval by the Ministry of Industries, Mines and Energy (MIME).

Lamda Energy said the deal increases Namibian ownership in the oil and gas sector, enhances local content, and provides direct benefits to the economy.

Eco Atlantic will continue to support the transition with technical expertise and will retain a seat on the board.

The agreement includes an upfront payment to cover administrative costs and provisions for Eco Atlantic to receive up to US$2 million (about N$37 million) if Lamda later farms out part of its stake to a third party.