BW Energy has allocated between US$650 million and US$700 million (approximately N$12 billion to N$12.95 billion) in capital expenditure for 2025, with key investments earmarked for upstream developments in Namibia and Brazil.

The company confirmed in its half-year report that an appraisal well on Namibia’s Kudu gas field will be drilled in the fourth quarter of this year, following the successful contracting of a rig.

“At Kudu, we are preparing for the drilling of an appraisal well targeting the Kharas structure. A rig has been contracted, and start-up of drilling is planned for the second half of 2025,” BW Energy stated.

The Kudu project forms part of BW Energy’s broader strategy to increase production through “phased, capital-efficient developments.”

The appraisal drilling is being undertaken in partnership with NAMCOR E&P, a subsidiary of the National Petroleum Corporation of Namibia.

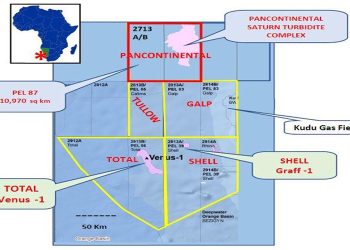

BW Energy holds a 95% operating interest in the Kudu production licence (PPL003), while NAMCOR E&P retains a 5% carried interest. The company said it is also making progress on the Kudu gas-to-power project, which is being developed in close consultation with Namibian authorities and the local power utility.

“We continue to progress the Kudu gas-to-power project in close dialogue with Namibian authorities and the local power company,” the company noted.

In a further expansion of its Namibian portfolio, BW Energy has acquired a 20% working interest in onshore Petroleum Exploration Licence 73 through a farm-in agreement with ReconAfrica. Drilling of an exploration well on this acreage is scheduled for the second half of 2025.

A major portion of BW Energy’s 2025 capital expenditure will also support the Maromba development in Brazil, which includes refurbishing a Floating Production Storage and Offloading (FPSO) vessel and converting a rig into a wellhead platform. First oil from Maromba is targeted by the end of 2027, with estimated recoverable resources of 123 million barrels.

In Brazil, the company will also advance the Golfinho Boost project, which aims to increase production by 3,000 barrels per day, add 12 million barrels of reserves, and reduce operational costs.

BW Energy’s production guidance for 2025 remains at 11 to 12 million barrels, with full-year operating expenses forecast between US$18 and US$22 (N$333 to N$407) per barrel.

General and administrative expenses are expected to fall between US$19 million and US$22 million (N$351.5 million to N$407 million).

During the first half of 2025, the company recorded net production of 6.2 million barrels, averaging 34,200 barrels per day. Operating expenses stood at US$18.3 (N$338.55) per barrel, while BW Energy’s cash position at the end of June was US$192.9 million (approximately N$3.56 billion).