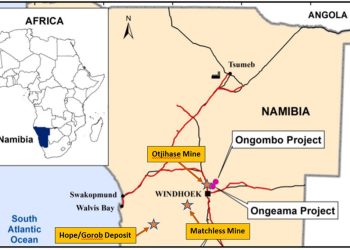

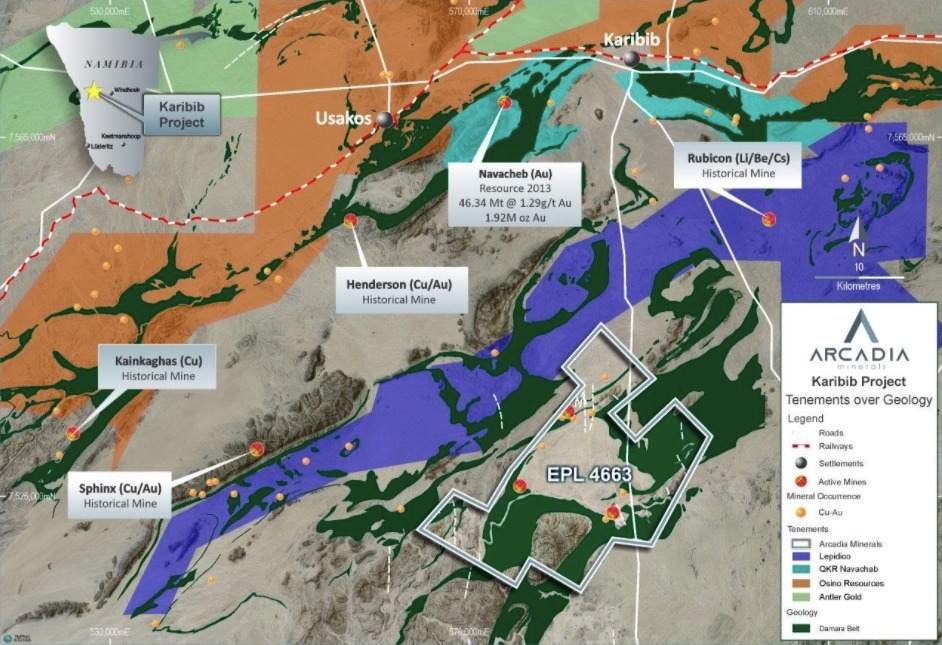

Arcadia Minerals Limited has signed a binding four-stage farm-in agreement with Kaoko Metals (Pty) Ltd to advance its 80%-owned Karibib Copper-Gold Project in Namibia.

The deal allows Kaoko to earn up to a 100% interest in Karibib Pegmatite Exploration (Pty) Ltd (KPE), which holds an 85% stake in the project through Goas Pegmatite Exploration (Proprietary) Limited.

Under the agreement, Arcadia will receive a non-refundable deposit of N$396,200 (A$35,000) and staged cash payments totalling N$4.5 million (A$400,000), along with milestone share payments of up to 2.25 million Kaoko shares and a 2% Net Smelter Royalty.

The structure allows Arcadia to retain long-term exposure to the project while minimising shareholder dilution.

“This agreement with Kaoko Metals represents an important step in the advancement of the Karibib Copper-Gold Project. The staged farm-in structure introduces a committed partner to fund exploration and development, while Arcadia retains significant exposure to the upside through cash consideration, milestone share payments and a royalty interest,” said Arcadia Executive Chairman, Jurie Wessels.

Wessels added that the deal supports Arcadia’s broader strategy of working with aligned investors to advance high-potential projects while conserving capital and maintaining upside exposure to Namibia’s growing copper-gold sector.

“It reflects our strategy of advancing our portfolio in a manner that minimises dilution to Arcadia shareholders while ensuring our projects continue to move forward,” he said.

Kaoko Metals, led by Managing Director Gerard O’Donovan, plans to list on the Australian Securities Exchange (ASX) to raise at least N$56.6 million (A$5 million) to support the earn-in.

O’Donovan said the agreement complements Kaoko’s existing copper-focused assets in the Kaoko Belt and aligns with its strategy to unlock value in African base and precious metal projects.

The staged farm-in allows Kaoko to progressively increase its ownership through exploration expenditure and resource milestones, culminating in a feasibility study confirming a minimum 150,000-ounce gold-equivalent resource.

“Coupled with our other copper-focused project located in the Kaoko Belt, we are building a suite of projects with immense potential, which we plan to unlock,” O’Donovan said.