Reconnaissance Energy Africa Ltd will not publish a formal resource estimate for its Kavango Basin discovery until production testing and at least one appraisal well have been completed, as the company prioritises flow data over early volumetric assessments.

Chief Executive Officer Brian Reinsborough said the company’s immediate focus is on gathering dynamic data to inform development planning and any future independent resource assessment.

“We are focused on dynamic data first. That will inform appraisal, development scenarios and ultimately an independent resource assessment,” Reinsborough said.

He said initial development concepts under consideration include phased onshore production, with early scenarios ranging from oil-only to gas-only or mixed developments, depending on the outcomes of production testing.

Reinsborough noted that Namibia’s onshore operating environment offers logistical advantages, including proximity to paved highways, power infrastructure and the port of Walvis Bay, which could materially reduce development costs and shorten timelines.

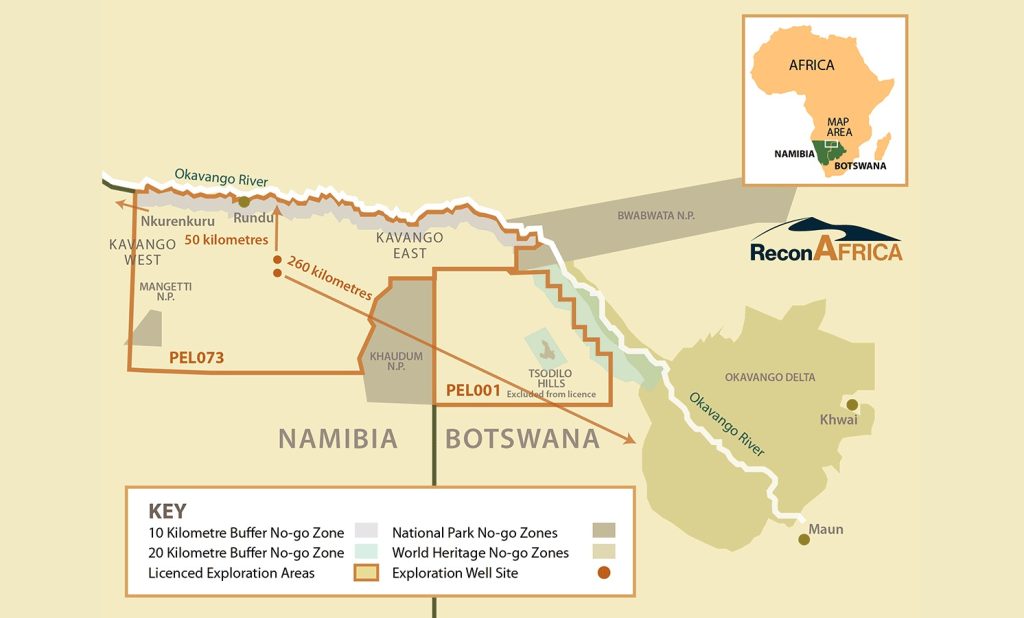

He said the recently drilled Kavango West-1X well marked a turning point for the company’s Namibia operations after confirming all key elements of a working petroleum system, including source rock, reservoir quality, sealing capacity and structural trapping.

“This well brought everything together in one structure,” Reinsborough said, adding that the results supported a move directly into production testing rather than further exploratory drilling.

ReconAfrica is targeting late first quarter to early second quarter of 2026 for a production test at Kavango West-1X, subject to final engineering design and procurement.

“The test is expected to evaluate multiple reservoir zones and provide critical data on flow rates, pressures and reservoir continuity,” he said.

Reinsborough said appraisal drilling would follow production testing and is likely to focus on step-out wells along existing seismic lines to delineate the discovery while remaining within current environmental approvals.

He confirmed that ReconAfrica is in ongoing discussions with BW Energy, NAMCOR and the Namibian government regarding appraisal planning, development concepts and alignment with the country’s broader energy objectives.

“These discussions are about how an onshore development could progress responsibly and efficiently, and how it could fit into Namibia’s long-term energy strategy,” Reinsborough said.

On funding, he said the company remains well funded in the near term, with final capital allocation for 2026 to be determined once production test costs are fully defined. ReconAfrica continues to assess funding options while maintaining capital discipline, he added.

Providing broader regional context, ReconAfrica technical adviser Chris Sembritzky said the company is also advancing technical work in Gabon and Angola, although Namibia remains its primary focus.

Sembritzky said ReconAfrica is reviewing and reprocessing seismic data over the Ngulu offshore block in Gabon, which contains an existing discovery, to refine subsurface understanding and determine next steps towards potential appraisal or development.

“The goal is to apply modern seismic techniques to better define the resource before committing additional capital,” he said.

In Angola, he said the company plans to begin early-stage exploration work in 2026, including surface geochemical sampling and regional two-dimensional seismic acquisition aimed at basin evaluation.