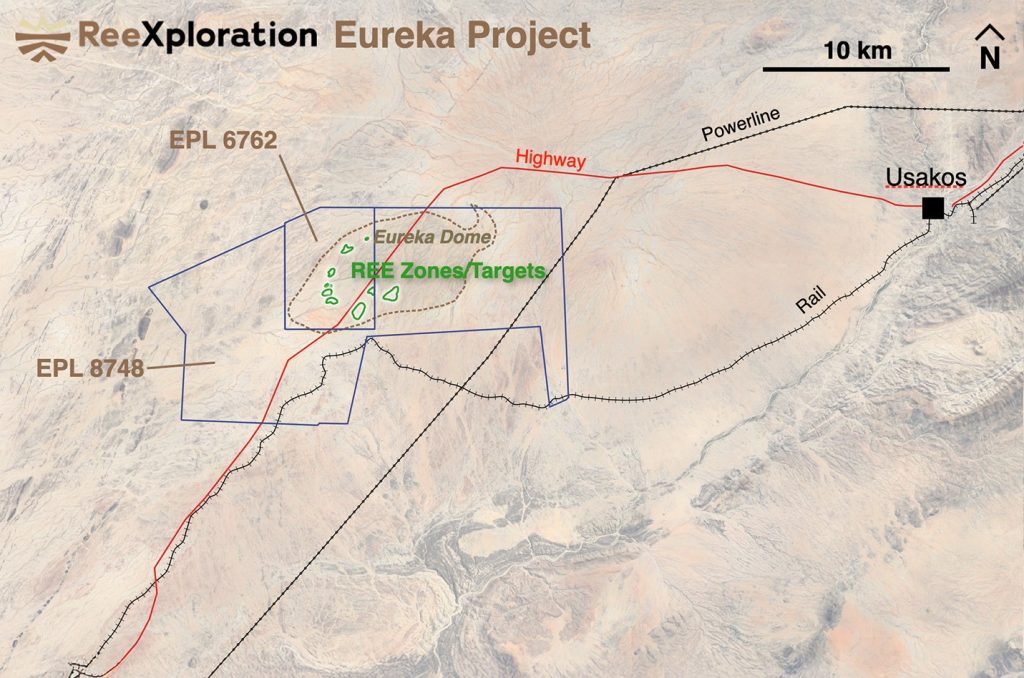

ReeXploration has launched a private placement to raise N$16.7 million (US$1 million) to fund the next phase of exploration at its Eureka Project in Namibia.

The company said the funds will primarily be used to finance a critical drilling programme scheduled for early 2026. The programme will target a newly identified, highly prospective uranium deposit located immediately south-west of the Eureka Dome, within Namibia’s premier uranium corridor in the Erongo Mining District.

According to the company, the new target is considered significant as it lies along the same geological trend as several major global uranium deposits, including Rössing, Husab, Etango, Omaholo and Norasa, placing it within one of the world’s most prolific uranium belts. Proceeds from the placement will also be allocated to general working capital.

“Proceeds from the financing will be used primarily to fund a drill programme designed to test a newly identified and highly prospective uranium target in early 2026, along with general working capital,” the company said in a statement.

The financing will comprise up to 9,090,910 shares priced at US$0.11 per share. To facilitate the offering, ReeXploration has engaged Numus Capital Corp, an exempt market dealer, as agent.

The company has agreed to pay the agent a 7% cash commission and issue compensation warrants equal to 7% of the shares sold to investors introduced by the agent.

Completion of the private placement is subject to a number of conditions, including approval from the TSX Venture Exchange.

ReeXploration is a Canada-based exploration company focused on critical minerals required for the clean energy transition. The company says its multi-commodity Eureka Project is positioned to help meet growing global demand for secure and responsibly sourced supplies of rare earth elements and nuclear fuel.