B2Gold Namibia says its rehabilitation fund, established to cover all environmental obligations at the end of the mine’s life, has now grown to more than N$200 million.

“At the moment we’re just funding it through a high interest-bearing fund that is reinforced, that we can just dip into whenever we are conducting rehabilitation and the current balance is north of N$200 million,” Country Manager John Roos said.

The company is pursuing progressive rehabilitation while operations continue, with restored slopes at the open pit site now hosting roaming Oryx.

“Crucially, we are establishing a rehabilitation fund in Namibia that will cover all environmental obligations for the mine’s closure. By the end of this year, the fund will ensure that the costs of restoring the land, potentially hundreds of millions of Namibian dollars, are fully secured,” Roos said.

He added that the approach prevents future operators or the government from carrying the burden, reflecting global best practice applied across all B2Gold operations and setting a benchmark for Namibian mining legislation.

“From 2015 to 2024, while shareholders receive returns, the broader impact is significant through employment, local procurement, and investments in environmental and social initiatives. The rehabilitation fund ensures that the land we use is restored, leaving Namibia in a better position for the future,” he said.

Beyond rehabilitation, B2Gold is expanding its sustainability efforts through renewable energy and agriculture.

The company commissioned a seven-megawatt solar plant in 2018, connected it to the grid in 2022, and now operates 17 megawatts of solar capacity.

“We now have 17 megawatts of solar capacity on-site, and we’re negotiating with the MSB to increase the cap, aiming to become the greenest mine in Namibia,” Roos said.

B2Gold has also invested in farming, producing 700 tonnes of maize this season.

“We grow maize and are one of the largest privately owned maize farmers in Namibia. Just this season, we harvested 700 tonnes of maize, demonstrating how we’re investing in our land and thinking beyond mining,” Roos said.

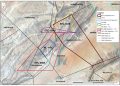

The company is preparing for the closure of its Otjikoto open-pit mine and transition to underground mining at the Wolfshag deposit, expected to run until 2027.

It is also advancing the nearby Antelope deposit, about four kilometres southwest of Otjikoto. A Preliminary Economic Assessment released in February indicated that Antelope could produce around 327,000 ounces of gold over five years, with average annual output of about 65,000 ounces, potentially sustaining and enhancing Otjikoto’s production profile into the next decade.