Dundee Precious Metals Inc. (DPM) has announced its entry into a definitive agreement to acquire Osino Resources Corp., a gold exploration company developing the Twin Hills project in Namibia.

Under the agreement, Dundee’s consideration comprises C$0.775 in cash per Osino share and 0.0801 of a DPM common share per Osino share.

The acquisition implies a value of C$1.55 per Osino share and a total equity value of N$4 billion (C$287 million).

Upon completion of the acquisition, DPM will issue 13,766,364 shares to Osino shareholders, and existing Osino shareholders will own around 7% of the combined company.

The acquisition of Osino is expected to enhance DPM’s asset portfolio.

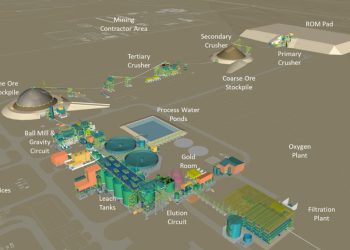

A feasibility study by Osino in June outlined an open-pit project with a 13-year mine life and average annual production of 175,000 ounces of gold over the first five years, with first production targeted in the second half of 2026 in Twin Hills.

“Twin Hills represents a unique opportunity to add a high-quality development asset in an excellent mining jurisdiction to our portfolio. The project provides a foundation for our future production profile, with production targeted for 2026, as well as significant exploration upside,” said David Rae, CEO of Dundee Precious Metals.

Twin Hills is a multi-million-ounce gold project of Osino with 2.15 million ounces of Proven and Probable Reserves located in Namibia.

Osino has a dual listing on the Namibian Stock Exchange.